NEWS

A lenticular limited edition print by Kosuke Motohashi was released in a limited edition of 150 copies.

Seguite TRiCERA su Instagram e date un'occhiata ai nostri artisti creativi

5%OFF e spedizione gratuita 1° acquisto

FIRSTART5

10%OFF sul 2° acquisto dopo il 1°!

Benvenuti in TRiCERA

Hi there! Siamo lieti di averla qui 🎉

Potresti descriverti?

Ospite

The art market in Japan, which boasts the third largest GDP in the world, is small in size, a fact that is not surprising in the art scene. For this reason, the Japanese art market is undervalued. However, just as in the stock market, this means that there is great value in investing in the Japanese art market.

According to data released by the Art Tokyo Association, the value of art exports from Japan in 2016 was approximately 35 billion yen, and Japan's share of the global art market was 3.1%, compared to 40% for the United States and 20% for China. This gives us an idea of the potential for the Japanese art market to rise.

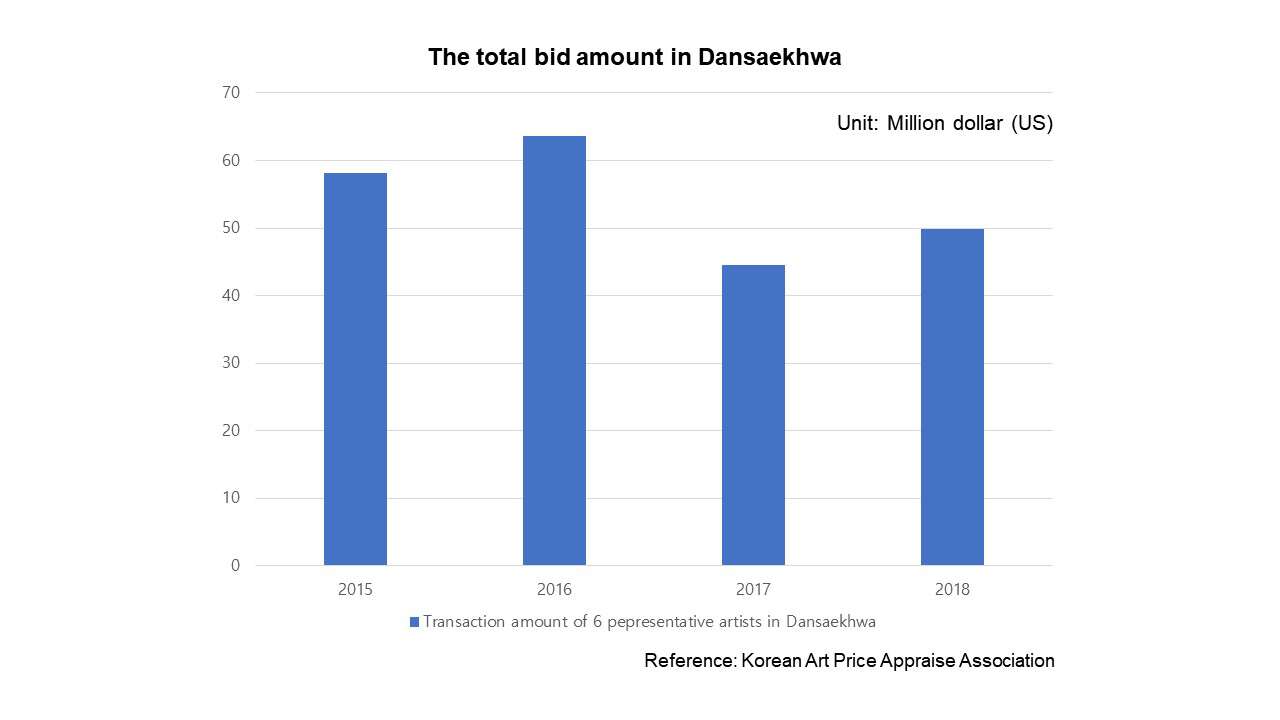

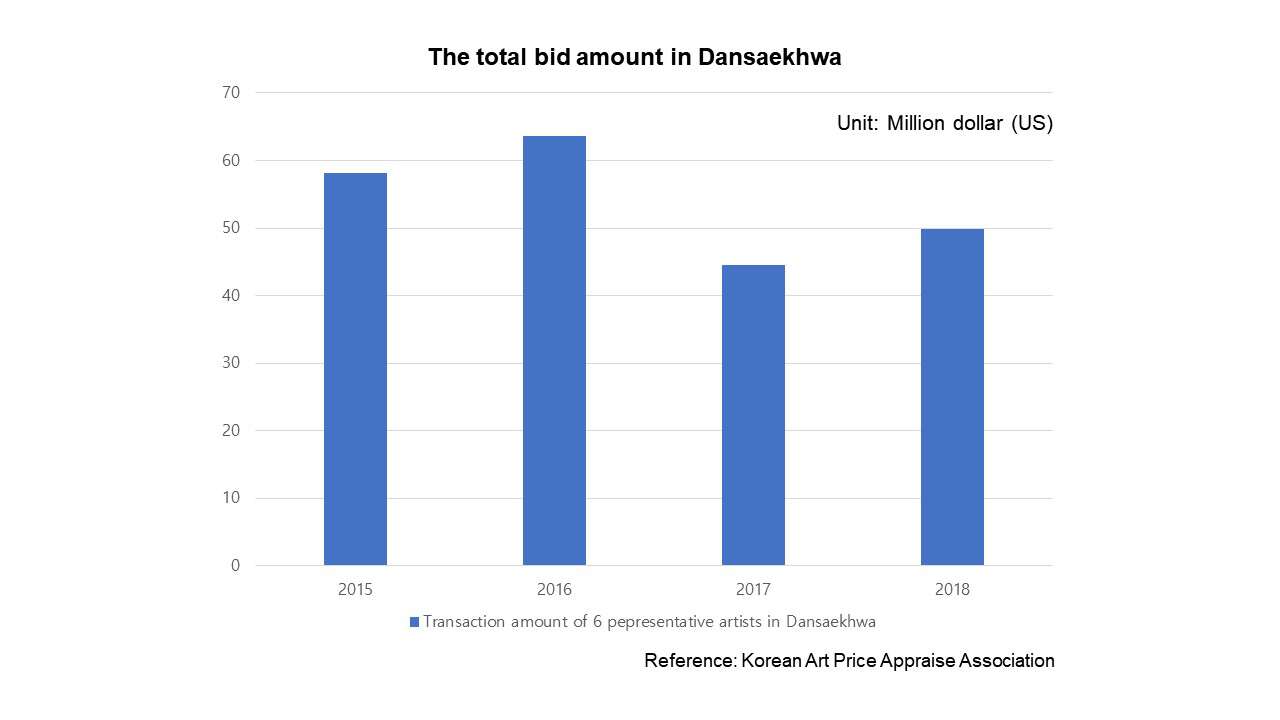

So, you may be wondering what kind of art and which artists you should invest in. In general, we tend to focus only on famous artists because of their low risk. However, investing in famous works is much riskier than buying works by younger, lesser-known artists. For example, the following statistics on one of Asia's most popular art genres, the Korean-style monochrome movement "Dansaika," show the recent volatility in the global art market.

The data chart above is based on six artists representing "Dansaehwa": Kim Hwan-ki, Lee Woo-hwan, Jeon Sang-hwa, Park Seo-bo, Yoon Hyun-geun, and Ha Chung-hyun.

The main reason why many people tend to invest in famous artists with "isms" is safety based on tradability. However, as you can see from the chart above, investing in famous genres and artists is not the safest way to go. Recently, attempts to delve more into art historical values have come to the forefront so as not to focus only on "fads". As a result, there are growing voices asking, "Does this 'ism' seriously represent our society, identity, and times? This trend means that the "trust-worthy value" in mainstream works is turning into an insecure, unsecured asset.

However, works by relatively low-profile artists are likely to see their prices rise substantially, unless they quit their careers as artists, and their artistic value may be unearthed. In addition, given the undervaluation of the Japanese art market, it is not surprising to see optimism in investing in young and lesser-known Japanese artists who are working for an identity with artistic value.

China's bubble, which used to hold a 20% share of the global art market, will slowly burst, just like the "Dansaehwa" bubble in Korea. Compared to other Asian markets that have already grown, Japan's art market has been shown to be safe with potential for growth.

TRiCERA.net was established to connect the world with up-and-coming talents from Japan who are making a name for themselves in the world through exhibitions and awards. If you are looking to acquire a one-of-a-kind piece of art for your portfolio, look no further than the more than 100 artists whose work has the potential to bring great returns in the future.

Article written by: Jeongeun Jo

Born in Korea and currently lives in Japan. She is one of the members of TRiCERA, and graduated from the Graduate School of Fine Arts, Tokyo University of the Arts. She is also active as an artist.

Scrittore

Shinzo Okuoka

The art market in Japan, which boasts the third largest GDP in the world, is small in size, a fact that is not surprising in the art scene. For this reason, the Japanese art market is undervalued. However, just as in the stock market, this means that there is great value in investing in the Japanese art market.

According to data released by the Art Tokyo Association, the value of art exports from Japan in 2016 was approximately 35 billion yen, and Japan's share of the global art market was 3.1%, compared to 40% for the United States and 20% for China. This gives us an idea of the potential for the Japanese art market to rise.

So, you may be wondering what kind of art and which artists you should invest in. In general, we tend to focus only on famous artists because of their low risk. However, investing in famous works is much riskier than buying works by younger, lesser-known artists. For example, the following statistics on one of Asia's most popular art genres, the Korean-style monochrome movement "Dansaika," show the recent volatility in the global art market.

The data chart above is based on six artists representing "Dansaehwa": Kim Hwan-ki, Lee Woo-hwan, Jeon Sang-hwa, Park Seo-bo, Yoon Hyun-geun, and Ha Chung-hyun.

The main reason why many people tend to invest in famous artists with "isms" is safety based on tradability. However, as you can see from the chart above, investing in famous genres and artists is not the safest way to go. Recently, attempts to delve more into art historical values have come to the forefront so as not to focus only on "fads". As a result, there are growing voices asking, "Does this 'ism' seriously represent our society, identity, and times? This trend means that the "trust-worthy value" in mainstream works is turning into an insecure, unsecured asset.

However, works by relatively low-profile artists are likely to see their prices rise substantially, unless they quit their careers as artists, and their artistic value may be unearthed. In addition, given the undervaluation of the Japanese art market, it is not surprising to see optimism in investing in young and lesser-known Japanese artists who are working for an identity with artistic value.

China's bubble, which used to hold a 20% share of the global art market, will slowly burst, just like the "Dansaehwa" bubble in Korea. Compared to other Asian markets that have already grown, Japan's art market has been shown to be safe with potential for growth.

TRiCERA.net was established to connect the world with up-and-coming talents from Japan who are making a name for themselves in the world through exhibitions and awards. If you are looking to acquire a one-of-a-kind piece of art for your portfolio, look no further than the more than 100 artists whose work has the potential to bring great returns in the future.

Article written by: Jeongeun Jo

Born in Korea and currently lives in Japan. She is one of the members of TRiCERA, and graduated from the Graduate School of Fine Arts, Tokyo University of the Arts. She is also active as an artist.

Scrittore

Shinzo Okuoka